You can also subscribe to the ISCAI YouTube channel for informative video content.

获取免费新文章请关注ISCAI合作伙伴凯数智业的微信公众号:

The Growing Need for Supply Chain Finance

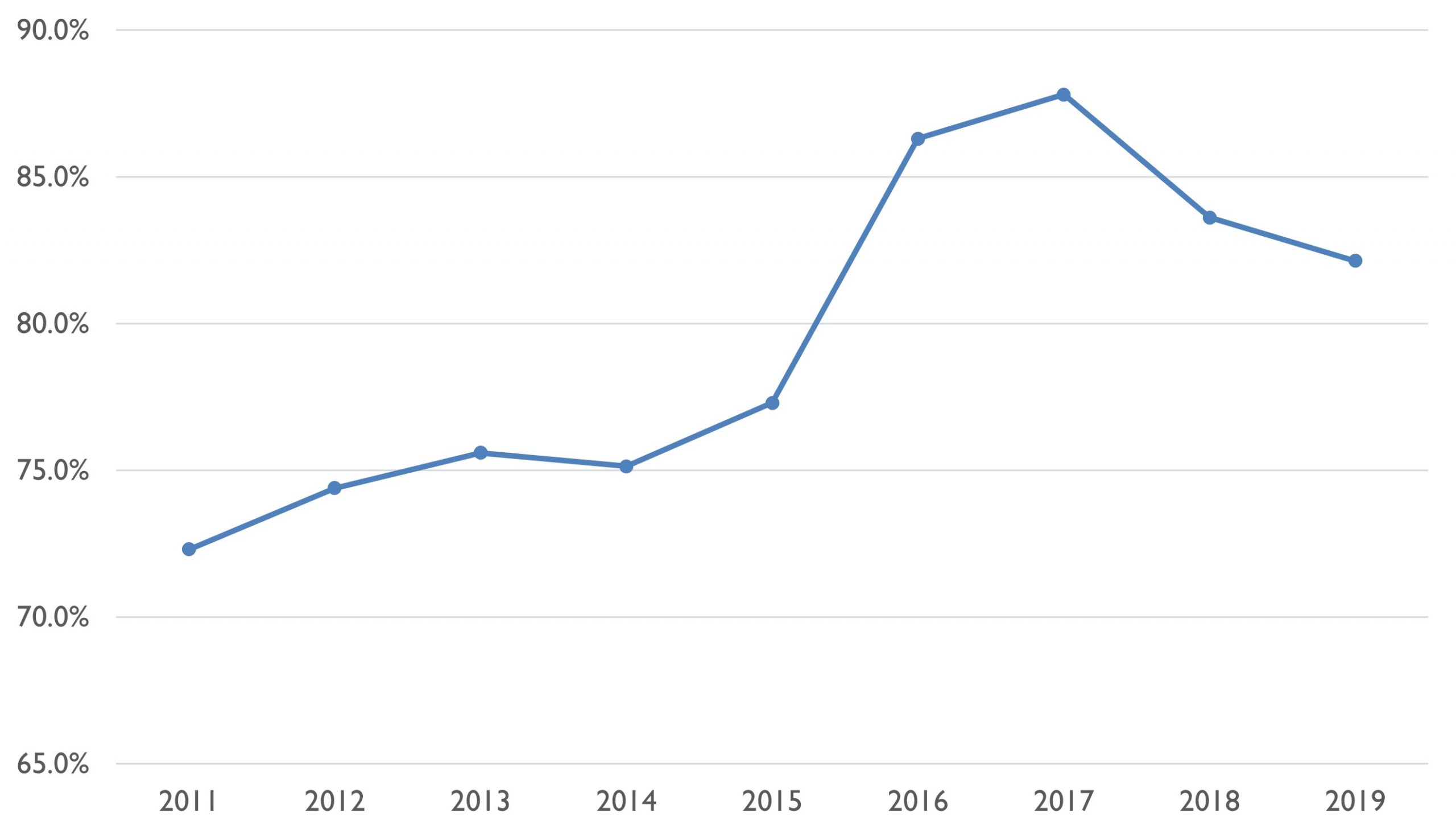

Traditionally, banks have been the main source of financing for capital-constrained companies. However, many of these firms have credit ratings below investment grade or lack any credit history, making it challenging for banks to provide loans. According to the National Credit Union Administration (NCUA) of the USA, as of 2019 Q2, 82.1% of US companies fell below investment grade (NCUA, 2019). Figure 1‑1 illustrates the increasing trend of firms below investment grade from 2011-2019.

Before the emergence of supply chain finance, financial institutions often assessed firms as individual, independent applicants for loans. In this process, firms were evaluated primarily on their financial standing and loan amount request, with little attention given to their supply chain partners. As a result, lending institutions would require information such as collateral, business plans, financial statements, insurance data, loan history, and credit ratings, often overlooking or undervaluing the firm’s supply chain relationships.

Despite over 80% of firms struggling to secure the necessary capital from banks, the integration of financial activities and supply chain events became increasingly important following the 2007-2009 global financial crisis and the subsequent economic downturn. This crisis led to a severe liquidity shortage, emphasizing the significance of cash flow and working capital for supply chain firms. However, subsequent bank regulations under Basel II and Basel III, aimed at mitigating financing risks and enhancing bank stability, further aggravated the liquidity challenges faced by firms.

The financial distress experienced by small businesses was further exacerbated during the colossal economic upheaval triggered by the outbreak of the Coronavirus (COVID-19) pandemic in 2020. The pandemic led to global panic and disorder. On January 23, 2020, the Chinese government enforced a 76-day lockdown in Wuhan city, which effectively brought the “world factory” to a standstill. Consequently, the backlog of container ships in Southern California ports surged to 109 in January 2020, compared to fewer than 10 in September 2021 (Ryssdal & Hollenhorst, 2022). On February 2, 2020, the US government closed its borders to visitors from China and later the rest of the world, as the COVID-19 outbreak rapidly spread throughout Europe and other countries. Ultimately, the pandemic proved to be devastating for all nations, severely disrupting global supply chains.

During COVID-19, public awareness of the importance of supply chain management (SCM) and supply chain finance reached unprecedented levels. The necessity for firms to seek alternative financing sources, besides banks, has never been more urgent. Consequently, supply chain finance has emerged as a strong alternative financing source.

What is Investment Grade?

Investment grade refers to a credit rating assigned to a debt security, indicating that the security is deemed to have a low risk of default and a high probability of timely payment of interest and repayment of principal. Typically, investment-grade ratings range from AAA (the highest rating from Standard & Poor’s, S&P, indicating an extremely low credit risk) to BBB- (the lowest rating in S&P). Securities with investment-grade ratings are generally considered suitable for investment by conservative investors. Securities rated lower than BBB- are classified as speculative grade or “junk bonds.” In Moody’s credit rating system, investment-grade ratings range from Aaa to Baa3.